We’ve seen this movie before. Planetary crisis, urgent innovation, huge investment deals, big projects, bigger targets, bubbly language, budgets burst, investments lost, reality realised, the end. Except this existential climate crisis has not played out yet, and the green hydrogen story has not ended. But… there might be a reality check. We don’t need a reminder of our climate crisis but let’s take a temperature check on the green hydrogen excitement of recent years with the following highlights:

Geologists signal start of hydrogen energy ‘gold rush’ – Financial Times

Get Rich Quick With These Three Hydrogen Stocks To Buy Now – Yahoo Finance

World’s First Green Steel Plant Secures $4.2 Billion in Funding – Bloomberg

Hydrogen Fuel Is Gaining Traction With Truckers – Wall Street Journal

The Global Race To Produce Hydrogen Offshore – BBC

The excitement has genuine scientific merit. As the world’s most abundant element, hydrogen enjoys two huge energy-related advantages. First, using hydrogen for energy purposes generates no greenhouse gas emissions as water is the only by-product of the process. Second, hydrogen has the highest energy per mass (MJ/kg) of any fuel. However, the headlines above hint at a potential mis-match of expectations between the rush to produce hydrogen and the actual end-use cases for the new green fuel.

The current reality is that the higher cost of producing green/clean hydrogen using electrolysis and the technological hurdles of transporting hydrogen are restricting commercial applications to those projects which can be located close to cheap renewable energy. According to a recent Reuters report, producing the “green” version of hydrogen costs about four times more than the dirtier version, Furthermore, the report cites IEA data showing that just 1% of the 1,600 of green hydrogen projects (by volume of production) have progressed in any significant way beyond exploratory stage. As a reminder of the target opportunities, a recent report by Partners Capital provided a good summary:

“What we can say with certainty from this analysis is that clean hydrogen will play a vital role in achieving global decarbonisation in settings where the direct use of electricity is impossible or inconvenient (e.g., long-haul trucking, steel production, maritime shipping, and aviation), or where hydrogen itself is important to the use case (e.g., fertiliser production).”

The blue sky view of hydrogen’s applications is that it could contribute to up to 20% of total global decarbonisation. But, we need to think about clean hydrogen as a fuel to be used where electrification is impractical. Now, hold that fuel thought and consider the IEA’s target of using hydrogen to offset 10% of total emissions in its 2050 Net Zero projections. That 10% target would need 600 million tonnes (Mt) of clean hydrogen production compared to a current starting position of just 24 Mt of announced hydrogen production projects today. It is little wonder that the Partners Capital report cites this ‘slow start’ as a major factor in their analysis and conclusion that clean hydrogen is more likely to ultimately contribute to just 6% of global decarbonisation. Note, this is not just Partners Capital beginning to rein in expectations.

The EU Court of Auditors has recently issued a report criticizing the EU Commission’s “unrealistic” targets which had earmarked production and import goals of 10 Mt of renewable hydrogen by 2030. The Financial Times in July flagged the report and production capacity shortfalls but also picked up on the other half of the clean hydrogen use-case equation – consumption:

“Consumption of renewable hydrogen in Europe in 2023 was just 0.11mn tonnes and Europe currently has only 324MW of green electrolysers, according to Hydrogen Europe — far below the commission’s target. The ECA report found that total EU funding for hydrogen-related projects between 2021 and 2027 had reached €18.8bn.”

Given the scale of investment is approaching €20 billion it is worrying to read renewable hydrogen consumption levels barely exceeding one tenth of a million tonnes (Mt) compared to IEA 2050 targets of 600 Mt. Influential hydrogen cheerleaders are also concerned. In recent weeks we have seen two high profile projects pulled:

*Danish renewables developer Ørsted has scrapped its FlagshipONE green hydrogen-to-methanol project in Sweden and is exiting the liquid e-fuels market, two years after taking a final investment decision (FID) on the project.

*Mining giant, Fortescue, has just ditched its goal of producing 15 million tons of green hydrogen a year by 2030. Andrew Forrest, the $38 billion Australian iron ore miner’s founder and a climate campaigner, has been one of hydrogen’s most vocal backers.

It would be easy with these headlines to take the pessimistic view and write off hydrogen. However, there is real opportunity if projects can line up these four factors:

- Financing

- Access to surplus cheap renewable energy

- Commercial production of steel or fertiliser

- Secure off-take customers in advance

The steel industry accounts for 7-9% of global CO2 emissions according to the World Steel Association. This feels like a realistic target activity which Partners Capital have described as impossible or inconvenient to decarbonise using electricity directly. So, it was interesting to read a recent Financial Times profile of H2 Green Steel which highlighted end-user customers secured in the auto sector and a fully integrated 700MW electrolyser plant producing 100,000 tonnes of hydrogen for steel production. The plant is located close to the Arctic Circle in northern Sweden and has received €6.5 billion of investment capital in debt, equity and government/EU grants.

Clearly, lots of viability boxes have been ticked, but the ‘cost’ factor is still critical. H2 Green Steel is quite open about the fact that its customers are paying a 25%-30% ‘green premium’ for their steel. Companies like BMW, Porsche, Volvo and Scania are prepared to pay more to reduce the emissions profile of their supply chain, and are committed to taking up to half of H2 Green Steel’s target output. Hopefully, this project and another Swedish green steel venture, Hybrit, become the benchmark projects for the European steel industry. It is noticeable that the latter project is a joint venture featuring a steel maker(SSAB), a power supplier (Vatenfall) and a miner of iron ore (LKAB) which highlights the requirement for ‘joined up thinking’ across the entire industrial ecosystem. This level of collaboration is less visible in other potential use cases like trucking, aviation and shipping. However, the size of the steel industry alone could support sufficient commercial consumption for eventual hydrogen success. And, there are hints of an improved cost/competitive environment on the horizon.

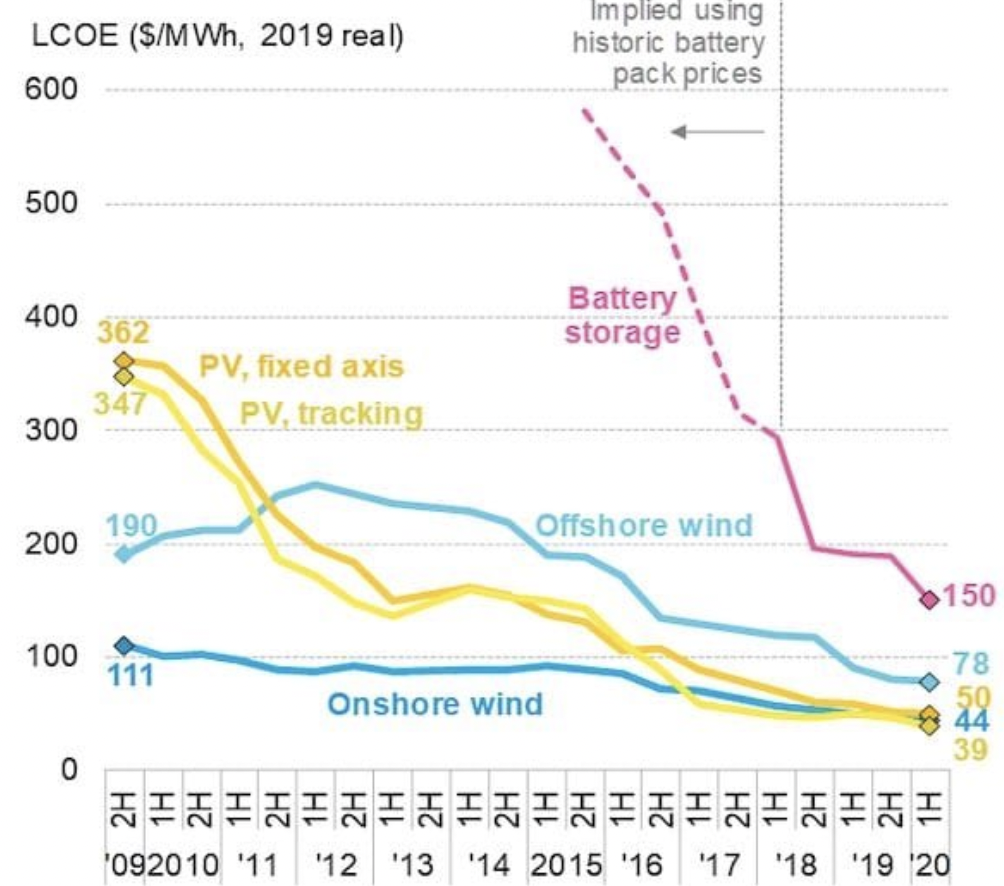

First, regulation and the impact of the EU’s Carbon Border Adjustment Mechanism due to come into effect for steel in 2026 will level the cost playing field versus ‘brown’ steel. Second, we have actually seen this movie before. Or, at least the data chart. Remember all the gloomy headlines on solar(PV), wind and battery costs? Well, check out the time-series chart below and note that slow starts (back in 2009) can end up with dramatic cost progress 10 years later (Source: Energy Post). We believe, despite the bumps and bubble-bursting headlines, there’s more gas left in this story….

Post Details

Category

Industry News

Date

August 21, 2024

Author

SilverBack

Tags

Cleantech (17)Construction (19)Decarbonization (20)Europe (19)H2 Green steel (4)infrastructure (6)

Leave a Comment